When life become stressful, payday loans for gig workers gives you confidence to move forward.

Lack of stable work and income in the life of gig workers makes it harder for them to qualify for traditional lending such as bank loans. Indeed, the gig economy growing steadily, but still lenders are not confident in the ability of gig workers to meet their loan repayments.

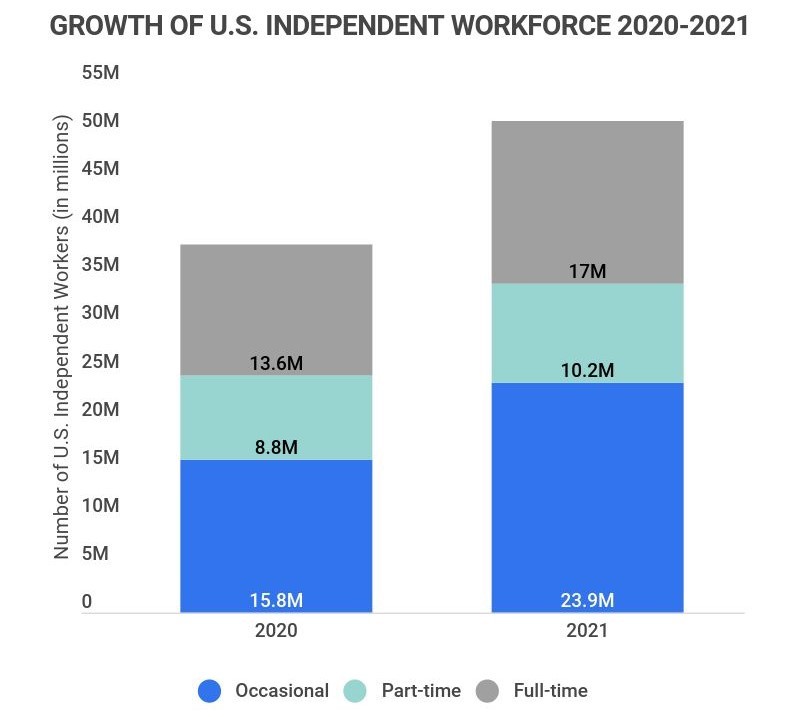

According to Statista, there are approx. 36% of US workers are part of the gig economy. So, it is difficult to estimate the exact facts about how big the gig economy is in the US. Many people are working as a freelancer in addition to their regular job.

Gig Economy Statistics 2022 – Editor’s Choice

👉 At least 59 million American adults participated in the gig economy over 2020, roughly to 36% of the U.S. workforce.

👉 16% of U.S adults have earned money through an online gig platform at some point in their lives, and 9% earned income from online gig work in 2021.

👉 Wages and participation for gig workers grew by 33% in 2020.

👉 Gig workers contributed around $1.21 trillion to the U.S. economy in 2020, which is roughly 7% of the total U.S. GDP.

👉 By 2023, experts predict that 52% of the American workforce will have spent some time participating in the gig economy.

Source: Zippia.com

Even though, 59 million active Americans participating in the gig economy, but still there are lots of people who are can’t able to get a simple loan. But the good news is that gig workers, independent contractors, and self-employed can apply for payday loans. In this article, we will try to cover everything about loans for gig workers.

What is the gig economy in simple terms?

In simper terms, a gig economy is a form of the labor market where people act like short-term independent contractors, and freelancers and perform various jobs for other people on a payment-by-task basis.

Instead of regular jobs, gig jobs are not associated with the office, or with a single company. Gig workers work as short-term, or as an independent contractor for one or various other employers.

“Tens of millions of Americans have told us that their ‘dream job’ is to work for themselves” – Mike McDerment, Co-founder & CEO @ FreshBooks

Due to COVID-19 Pandemic, more and more businesses and organizations are opting for gig workers for effective mobility of various operations. The other major reason behind boosting the gig economy is due to adaption of the smartphone.

As we see, most gig economy jobs are directly related to the activity of connecting two or more people to complete tasks. And smartphone plays a significant role in this.

Some popular gig economy companies are:

➡️ Amazon Flex – For licensed drivers interested in delivery services

➡️ Airbnb – For homeowners looking to monetize their property

➡️ Cabify – For licensed drivers who own a vehicle

➡️ Care.com – For certified caregivers and home service providers

➡️ Figure Eight – For professionals looking to contribute to AI and ML projects

➡️ Etsy – For artists and handicraft professionals

➡️ Onefinestay – For luxury homeowners looking to monetize their properties

➡️ Fiverr – For professionals in technology and media sectors

➡️ Talkspace – For licensed therapists and psychotherapy professionals with 3 years of experience

➡️ Shipt – For personal shoppers looking for flexible schedules

➡️ Uber – For licensed drivers across the world

➡️ Tongal – For experts in the media and entertainment sector

➡️ Share Now – For licensed drivers to benefit from car sharing

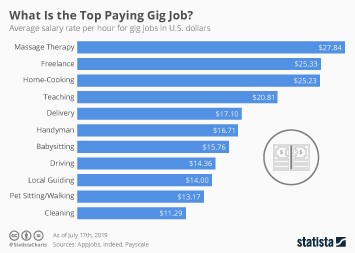

What do gig workers typically do?

Typically, gig workers are independent professional contractors or freelancers who do short-term work for multiple employers and companies. Instead of earning a regular income, these gig workers receive payment based on projects, or “gigs,” that they are completed.

Usually, most gig workers do multiple jobs and projects at a time to earn enough. Even some do freelance or contract basis work side by side of their traditional job to earn extra or sharpen their skills.

Types of gig workers

The gig economy is large enough, and gig workers work for many big industries, businesses, and organizations. Several businesses rely on gig workers. Some most common types of work for gig workers are:

✅ Freelancers

✅ Tutors and teachers

✅ Construction workers

✅ Finance professionals

✅ Administrative support professionals

✅ Foodservice and hospitality workers

✅ Transportation services

✅ Car Wash Attendant

✅ Personal Assistant

✅ Photographer

✅ Mover

✅ Background Actor

✅ Technical Support Specialist

✅ Content Writer

✅ Event Planner

✅ Photo Editor

✅ Driving Instructor

✅ Pet Groomer

✅ Pet Sitter

✅ Proofreader

Can I get a loan as a gig worker?

Yes, but you need to have a good or fair credit score to increase your chances of being approve for a loan. The gig economy in the United States is indeed big enough, but still, there are large numbers of gig workers who are experiencing loan rejection.

Getting loans for gig workers is not as easy because it might be hard for them to provide income proof. The gig economy provide workers flexibility in their work, but it is not so convenient when gig workers apply for a loan.

Most lenders require regular income and stable employment status when it comes to approving a loan application. The gig economy is like doing casual work and lenders assume that gig workers have no solid financial background. It could be difficult for gig workers to qualify for a regular loan, but still, there’s hope exists.

At Paydayapr.com, we offer payday loans for gig workers and cash advances for self-employed to our hardworking gigs. You could apply for as little as $100 up to a max of $5,000 within 10-15 minutes, no additional questions will be asked.

What loans are available for gig workers?

Yes, there are loans available for gig workers. If you earn enough income to afford loan repayments, you can apply for loans such as payday loans. Let’s discuss below some loan options for gig workers:

🔰 Secured loans: These loan are also known as homeowner loans or secured loans. Secured loans are a type of loan that is approved based on valuable assets as collateral, usually your property. By submitting collateral, the risks for the lender becomes less, and you may get bigger loans at lower interest rates.

🔰 Line of credit: As we know, traditional loans come with a fixed term, but a line of credit gives you the advantage of access extra money whenever you need it. You could borrow money as per your requirement and only need to pay interest on your borrowed amount. These loans give more flexibility and convenience.

🔰 Fixed-rate loans: As the name indicates, the interest rate on your loan stays steady and the same for a lifetime. The income of gig workers always fluctuates, and variable interest rate is not suitable for them, so fixed-rate loans are best option.

🔰 Co-signed loans: For those whose income is not stable or have a poor credit history, a co-signed loans may be an excellent option. Once adding a co-signer to the loan, you could decrease your interest rate and make your loan more affordable.

🔰 Social loans: When you borrow money from your family members or friends, it’s called social loans. If your credit score is bad, your income is unstable, but your relationships are good, then such loans are the best to opt for. There is no need for excellent credit history, and you can avoid borrowing at high-interest rates.

🔰 Payday loans:As we all know, gig workers do not earn a regular paycheck, and their income depends upon what gig they are working for. But thank god, they can apply for payday loans for gig workers and get up to $5,000 even with a bad credit profile. Payday loan lenders are more likely to approve you for a loan, if you can afford the repayments on time.

How can gig workers qualify for a payday loan?

Each lenders have their own eligibility criteria for their loan, but here we are showing most common basic requirements that you must have to qualify for a payday loan as a gig worker:

👍 Must hold U.S. citizenship and permanent address,

👍 Earn income and must show income-proof ,

👍 The applicant age must be at least 18 years old,

👍 Have valid and active mobile number and email id and,

👍 No criminal economic crimes record.

If you are working as a freelance, then make sure to arrange your documents in advance that confirm your proof of income. Payday loans for gig workers are majorly approved on the basis of income proof, so ask your employer to issue Wage Statement.

Is there a future for the gig economy?

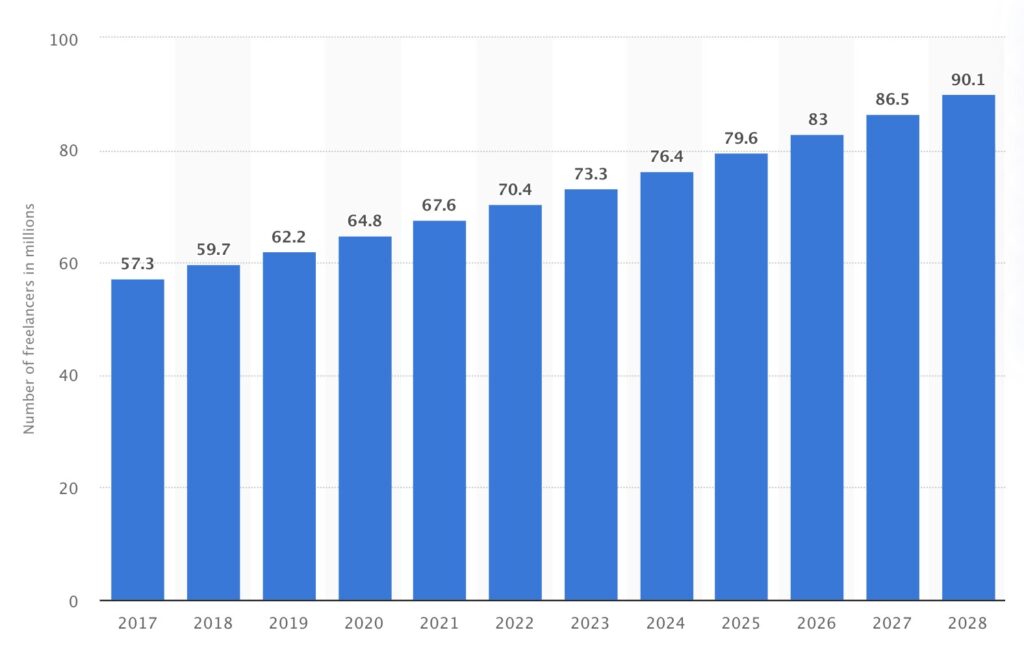

Number of freelancers in the United States from 2017 to 2028 (in millions)

Yes, no doubt. It is now prove that gig workers provide flexibility to businesses and organizations to meet the demand. They work as a middle chain between companies and customers and provide effective commerce.

The other side story is that gig workers increasingly encounter various difficulties and challenges. High gas prices, a competitive labor market, and growing inflation increase their costs than earning.

Gig workers nationwide raise their voices to get higher pay and to improve their working conditions. Big companies like DoorDash, Uber, and GoPuff faced strikes from contractors and gig employees. As a result, A lot of gig workers in the United States should be classified as “employees” who deserve work benefits, said- President Biden’s labor secretary. Source: Reuters®.

The future of the gig economy and workers is on the brighter side. Biden administration supports them, and soon gig workers will get more benefits like regular employees.

Writer/ex-teacher/lover of milkshakes. Lives with one bookseller and three cats.